Taking Full Control of Your Finances

Course Overview:

“Taking Full Control of Your Finances” is an all-inclusive course by Course Plus, designed to help individuals gain mastery over their personal finances. This course equips you with practical strategies to assess your financial health, create tailored budgets, pay off debt, track expenses, and plan for future investments. Whether you’re looking to eliminate financial stress, organize your finances with a partner, or build an emergency fund, this course will guide you every step of the way. With expert tips and downloadable templates, you’ll be empowered to create a sustainable financial plan that aligns with your goals.

Why Enroll in this Course?

Managing personal finances is no longer optional—it’s essential. With Course Plus, you’ll gain access to a structured learning experience that makes complex financial concepts easy to understand. This course is perfect for individuals at any stage of their financial journey, offering lessons on budgeting, debt management, investing, and creating financial harmony with your partner. You’ll also learn practical techniques for tracking expenses and boosting your net worth. By enrolling, you take a step toward financial independence, peace of mind, and future security. Designed with both beginners and experienced individuals in mind, this course will provide the tools and confidence needed to take control of your financial life. Your future self will thank you for it.

Investment Value:

- Lifetime access to 18 structured lessons designed to build financial literacy.

- Includes downloadable templates to simplify budgeting and financial tracking.

- Learn proven strategies for paying off debt and growing wealth.

- Comprehensive lessons on investing, cash flow management, and creating emergency funds.

- Affordable pricing with high-value content designed to create long-term financial benefits.

Technical Specifications:

- Course Duration: Approximately 8 hours (self-paced).

- Format: Video lessons, downloadable resources, and quizzes.

- Accessibility: Accessible on desktop and mobile devices.

- Resources: Budgeting templates, worksheets, and calculators included.

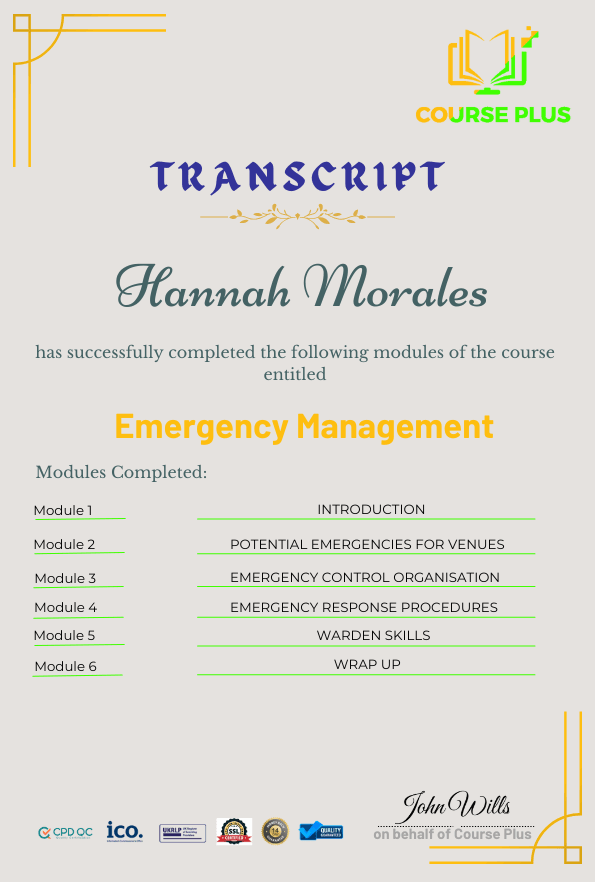

- Certification: Earn a certificate of completion from Course Plus.

Learning Outcome

- Understand your current financial situation.

- Create intentional and personalized budgets.

- Learn strategies to track expenses both manually and digitally.

- Develop a plan to pay off debt effectively.

- Calculate and improve your net worth.

- Grasp the basics of investing and compound interest.

- Master the envelope budgeting system.

- Organize your financial life and maintain clarity.

- Build an emergency fund for financial stability.

- Learn to work collaboratively with your partner on financial goals.

Conclusion

“Taking Full Control of Your Finances” by Course Plus is your gateway to financial freedom. Whether you’re a beginner or a seasoned individual looking for practical strategies, this course provides you with actionable tools to achieve your goals. With a focus on budgeting, investing, and debt repayment, you’ll feel empowered to take charge of your financial journey. Enroll today and transform your financial future!

Next Steps:

- Register on Course Plus platform

- Access course materials

- Join community discussions

- Earn certification

Course Curriculum

TAKING FULL CONTROL OF YOUR FINANCES

-

Introduction

03:00 -

Why Are You Doing This Course?

04:00 -

How to Download the Template

03:00 -

Becoming Aware of Your Current Situation

21:00 -

Creating an Intentional Budget

19:00 -

Comparing Your Options

08:00 -

Creating Specific Budgets

09:00 -

Calculating Your Net Worth

05:00 -

Understanding Your Cash Flow

09:00 -

How to Pay Off Debt Fast

12:00 -

Investing and Compound Interest

08:00 -

How to Track Your Expenses with Paper Receipts

09:00 -

How to Track Your Expenses Digitally

06:00 -

The Envelope System

06:00 -

Why and How to Create an Emergency Fund

05:00 -

How to Organize Your Financial Life

06:00 -

How to Organize Finances with Your Partner

08:00 -

How to Find Help and Next Steps

04:00

Student Ratings & Reviews

-

LevelIntermediate

-

Duration2 hours 25 minutes

-

Last UpdatedMay 23, 2025

A course by

Material Includes

- 24/7 Support

- Online e-learning platform

- Interactive modules

- Video-based instruction

- Practical exercises

- Certification (on demand)

- Assessment on demand

Requirements

- Minimum age: 18 years

- Access to a computer with internet

- Willingness to learn and engage

Target Audience

- Professionals looking to optimize their finances.

- Students seeking to learn the basics of budgeting and investing.

- Entrepreneurs aiming to manage personal and business finances.

- Newlyweds planning their joint financial journey.

- Retirees looking for ways to stretch and grow their savings.

- Non-professionals eager to learn about financial independence.