QuickBooks Self-Employed

Course Overview:

Master QuickBooks Self-Employed with this comprehensive course on Course Plus. Designed for freelancers, self-employed individuals, and small business owners, this course covers everything from setting up your account to generating reports. Learn to manage your taxes, track expenses, and categorize transactions with ease. Explore tips and tricks to leverage QuickBooks Self-Employed for accurate bookkeeping and better financial decisions. Gain confidence in using this intuitive software to simplify your financial management processes.

Why Enroll in this Course?

Enrolling in the QuickBooks Self-Employed course on Course Plus empowers you to take control of your finances with confidence. Learn the advantages of QuickBooks Self-Employed, its key differences from QuickBooks Online Simple Start, and how it caters to freelancers and small business owners. This course provides actionable insights into setting up your tax profile, managing invoices, and creating rules for seamless transaction categorization. Avoid common pitfalls like duplicate transactions and explore how to generate essential reports such as profit-and-loss statements and tax summaries. With practical, step-by-step guidance, you’ll gain the skills to streamline your bookkeeping and improve your financial health. Take the first step toward better financial organization today!

Investment Value:

- Gain practical knowledge to set up and optimize your QuickBooks Self-Employed account.

- Save time and money by mastering expense tracking, categorization, and report generation.

- Improve your financial management skills, crucial for tax season and compliance.

- Access lifetime course materials and updates on Course Plus.

- Boost your confidence in managing finances like a professional.

Technical Specifications:

- Desktop, laptop, tablet, and mobile-friendly.

- QuickBooks Self-Employed subscription (not included).

- Lifetime access through the Course Plus platform.

- Email and community support included.

- Self-paced course.

Learning Outcome

- Understand the key features and benefits of QuickBooks Self-Employed.

- Set up your tax profile, vehicle, and health insurance information accurately.

- Link and manage your bank accounts and invoices.

- Categorize income and expenses effectively.

- Learn how to split, transfer, and create transaction rules.

- Generate and interpret essential financial reports.

- Avoid duplicate transactions and manage manual imports.

- Track miles driven for tax deductions.

- Explore differences between QuickBooks Self-Employed and other QuickBooks products.

- Gain confidence in managing your finances for better tax planning and compliance.

Conclusion

Join the QuickBooks Self-Employed course on Course Plus to simplify your financial management and maximize efficiency. Perfect for freelancers, small business owners, and anyone seeking better bookkeeping skills. With lifetime access and expert-led content, you’ll master QuickBooks in no time. Enroll now and take control of your finances today!

Next Steps:

- Register on Course Plus platform

- Access course materials

- Join community discussions

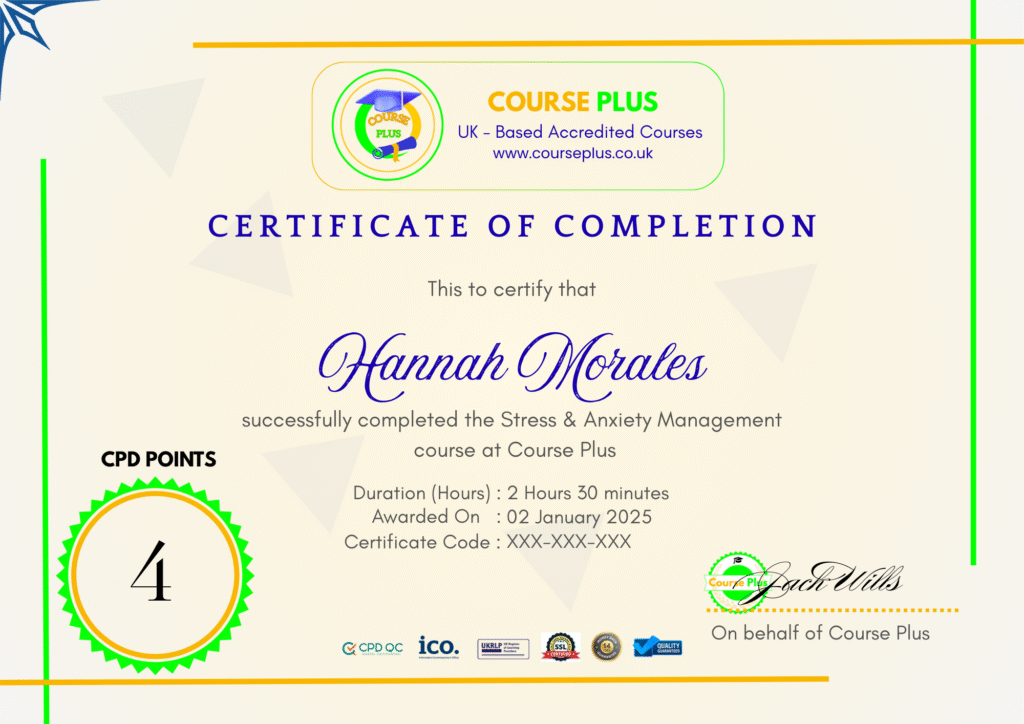

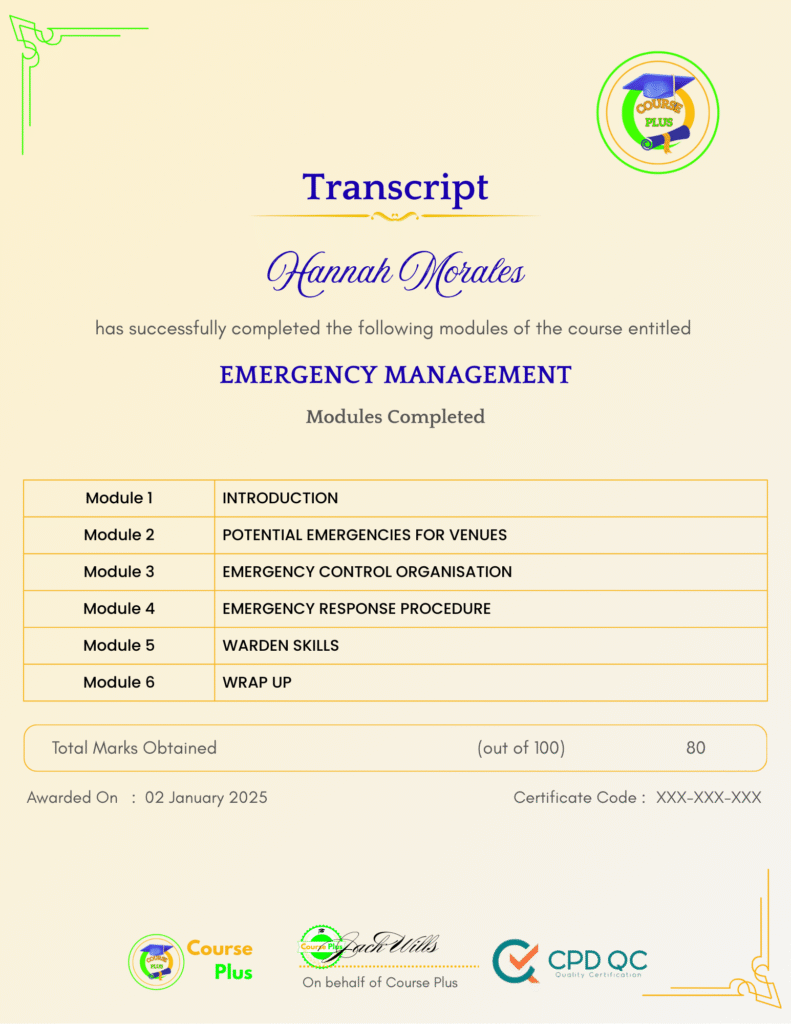

- Earn certification

Course Curriculum

INTRODUCTION TO QUICKBOOKS SELF-EMPLOYED

-

Who can benefit from QuickBooks Self-Employed

04:00 -

What QuickBooks Self-Employed can do for you

03:00 -

Advantages of QuickBooks Self-Employed

04:00 -

Disadvantages of QuickBooks Self-Employed

04:00 -

Comparison between QuickBooks Self-Employed and QuickBooks Online SImple Start

05:00

HOW TO SET UP YOUR QUICKBOOKS SELF-EMPLOYED ACCOUNT

-

Tax profile

04:00 -

Vehicle info

02:00 -

Health insurance info

03:00

BANK AND INVOICING

-

Bank account

04:00 -

Create an invoice

05:00 -

Manage an invoice

03:00 -

Expense receipts

04:00

TRANSACTIONS

-

How to add transactions

03:00 -

How to import transaction manually

02:00 -

How to treat diblicate transactions

02:00 -

How to export transactions

02:00

CATEGORIZATION

-

Categorization

02:00 -

Income and expense categories

02:00 -

Transfers

03:00 -

Rules

02:00 -

Split a transaction

02:00 -

Miles driven

03:00

BASIC REPORTS

-

Profit and loss report

03:00 -

Tax summary

04:00

Student Ratings & Reviews

-

LevelIntermediate

-

Duration1 hour 15 minutes

-

Last UpdatedSeptember 30, 2025

A course by

Material Includes

- 24/7 Support

- Online e-learning platform

- Interactive modules

- Video-based instruction

- Practical exercises

- Certification (on demand)

- Assessment on demand

Requirements

- Minimum age: 18 years

- Access to a computer with internet

- Willingness to learn and engage

Target Audience

- Freelancers and self-employed professionals.

- Small business owners seeking better financial management.

- Entrepreneurs who need to simplify bookkeeping tasks.

- Professionals transitioning to self-employment.

- Students in business or accounting looking to expand practical skills.

- Individuals preparing for tax season.