Personal Finances Management

Course Overview:

Course Plus presents the Personal Finances Management course, designed to help you master essential financial skills and achieve your financial goals. Whether you’re aiming to build an emergency fund, understand net worth, manage expenses, or save for retirement, this course offers step-by-step lessons tailored to your needs. With practical insights into budgeting tools like EveryDollar and strategies for optimizing income and expenses, you’ll be empowered to take control of your finances confidently. From understanding housing expenses to leveraging extra income opportunities, this course delivers actionable knowledge to improve your financial well-being.

Why Enroll in this Course?

Enrolling in the Personal Finances Management course on Course Plus equips you with the essential skills to effectively manage your money. This course is designed for individuals seeking to understand their financial standing and plan for the future with clarity. With lessons tailored to cover net worth, expense tracking, emergency funds, and retirement savings, you’ll gain a comprehensive understanding of personal finance areas. Learn how to use budgeting software, explore ways to generate extra income, and ensure your financial security with health insurance. Whether you’re a beginner or looking to refine your financial strategies, this course offers tools and techniques grounded in real-world scenarios. Start your journey to financial freedom today with Course Plus!

Investment Value:

- Learn to track and improve your net worth with practical examples.

- Save more efficiently by optimizing expenses like housing, utilities, and travel.

- Explore income-generating opportunities, including online work and unused assets.

- Build a robust emergency fund and plan effectively for retirement savings.

- Gain access to free budgeting tools like EveryDollar for smarter financial management.

Technical Specifications:

- Comprehensive lessons covering key personal finance topics.

- Practical exercises with real-life examples to enhance understanding.

- Guidance on using free budgeting software for efficient expense tracking.

- Strategies to identify income opportunities and manage savings effectively.

- Insights into retirement planning, emergency funds, and health insurance.

Learning Outcome

- Understand the concept of net worth and how to calculate it.

- Master expense management, including housing, utilities, and credit cards.

- Develop strategies to save on food, travel, and clothing expenses.

- Identify ways to generate extra income, both online and offline.

- Build an emergency fund and plan long-term savings for retirement.

- Learn to use EveryDollar, a free budgeting software, to track expenses.

- Gain insights into creating a financial dashboard for budget analysis.

- Develop skills to optimize health insurance and other essential financial plans.

- Understand the importance of gift and travel expenses in budgeting.

- Create a sustainable personal finance plan for long-term success.

Conclusion

Take charge of your financial future with the Personal Finances Management course by Course Plus. From mastering budgeting tools to understanding essential savings strategies, this course offers a comprehensive guide to achieving your financial goals. Start your journey to financial freedom today and make smart money decisions effortlessly.

Next Steps:

- Register on Course Plus platform

- Access course materials

- Join community discussions

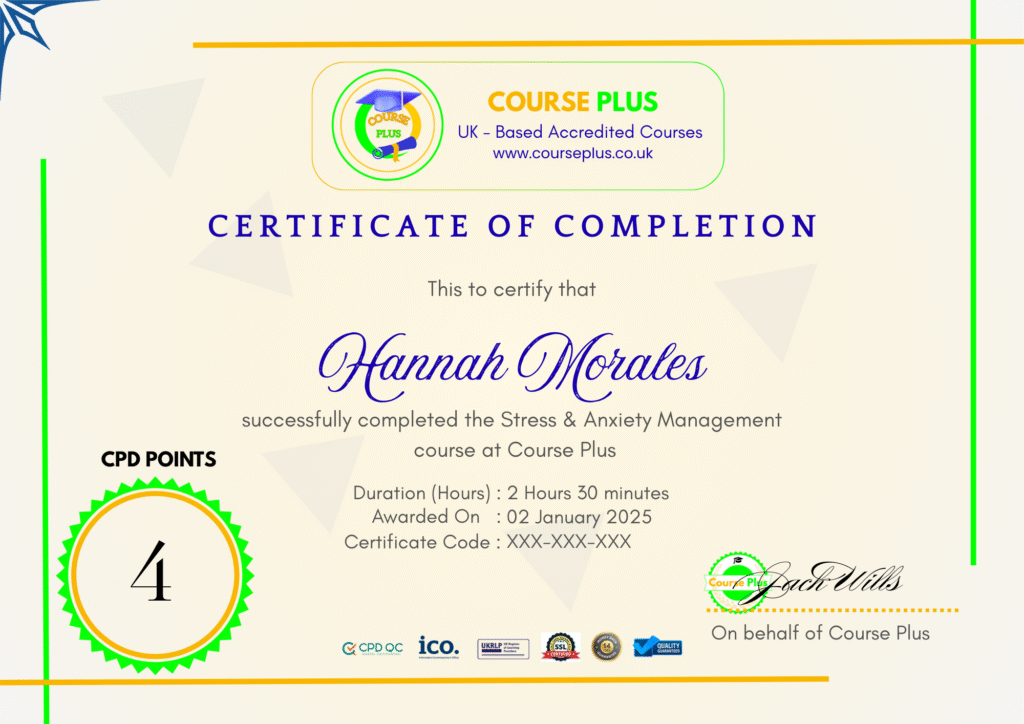

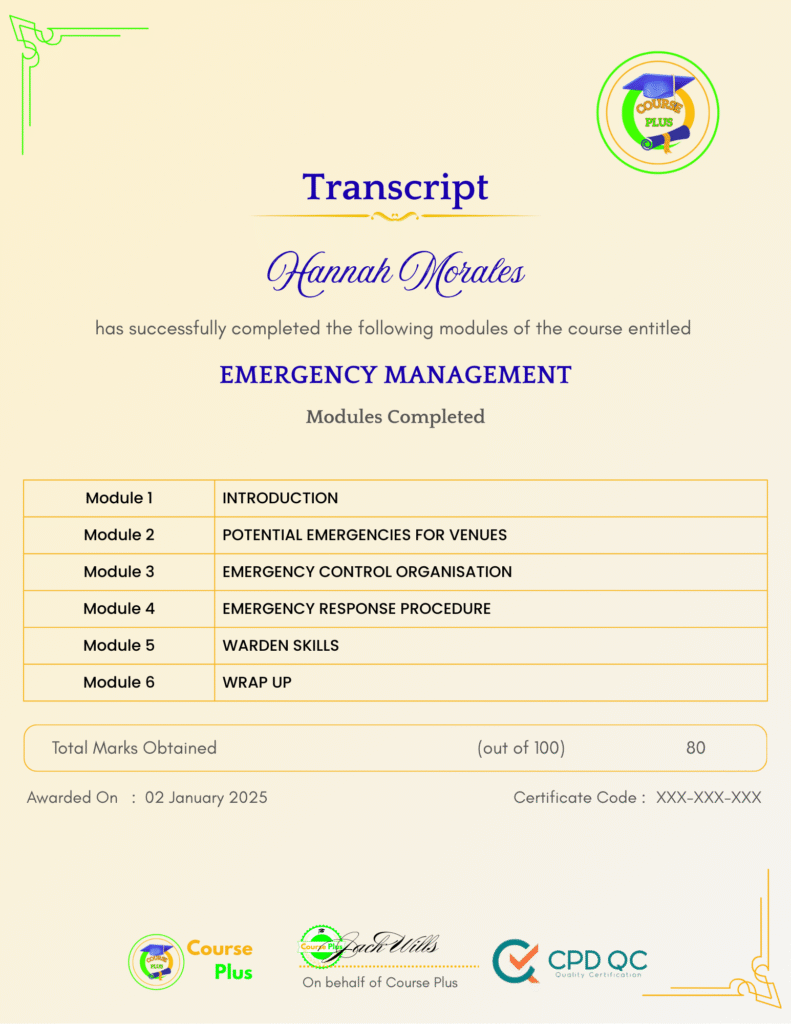

- Earn certification

Course Curriculum

INTRODUCTION

-

Personal Finance Introduction

02:00 -

Personal Finance

03:00 -

Areas Of Personal Finance

03:00 -

Net Worth

02:00

NET WORTH – EXAMPLE

-

Net Worth – Example

03:00 -

Housing Expenses

02:00 -

Utility Expenses

02:00 -

Credit Cards

02:00 -

Food Expenses

02:00 -

Clothing Expenses

02:00 -

Gift Expenses

02:00 -

Travel Expenses

01:00

EXTRA INCOME – SELL OR RENT OUT

-

Assets You Do Not Use

02:00 -

Extra Income On The Internet

03:00 -

Emergency Fund

03:00 -

Savings On Retirement

05:00 -

Health Insurance

04:00

EVERYDOLLAR – A FREE BUDGETING

-

Software

03:00

INFORMATION – PART 1

-

Setting up some basic information – part 1

02:00 -

Setting up some basic information – part 2

03:00

INFORMATION – PART 2

-

Dashboard

03:00 -

Budget Analysis

03:00

Student Ratings & Reviews

-

LevelIntermediate

-

Duration57 minutes

-

Last UpdatedSeptember 30, 2025

A course by

Material Includes

- 24/7 Support

- Online e-learning platform

- Interactive modules

- Video-based instruction

- Practical exercises

- Certification (on demand)

- Assessment on demand

Requirements

- Minimum age: 18 years

- Access to a computer with internet

- Willingness to learn and engage

Target Audience

- Professionals seeking to improve financial management skills.

- Non-professionals aiming to better understand personal finances.

- Students looking to build financial literacy.

- Freelancers and entrepreneurs managing irregular income.

- Families planning household budgets and future savings.

- Retirees focusing on efficient use of fixed incomes.