Payroll Management

Course Overview:

Master the intricacies of payroll management with our comprehensive online course on Payroll Management at Course Plus. Designed to simplify the complexities of payroll systems in the United Kingdom, this course provides practical insights into both manual and computerised payroll processes, including the renowned Brightpay software. Dive into the essentials of PAYE, taxation, and National Insurance while learning about real-time submissions, employee records, and end-of-year reporting. With detailed lessons and step-by-step guidance, this course ensures you are equipped to manage payroll efficiently for any organization.

Why Enroll in this Course?

Gain in-demand skills for managing payroll systems in the UK, covering PAYE, NI, and pensions.Learn how to effectively utilize Brightpay software, from setup to end-of-year reporting.Enhance your career prospects in HR, accounting, or business management with industry-relevant expertise.Enjoy the flexibility of learning at your own pace through Course Plus’s intuitive online platform.Build confidence in handling payroll compliance, coding notices, and real-time submissions.Secure your knowledge with a practical approach, including scenarios and reports tailored for real-world applications.

Investment Value:

- Affordable pricing with access to lifetime course materials.

- Practical training with real-world scenarios and examples.

- Certification upon completion to showcase your expertise.

- Access to expert support and updates on payroll systems.

- Opportunities to network with like-minded learners.

Technical Specifications:

- Device compatibility: Desktop, laptop, tablet, and mobile devices.

- Internet connection: Stable broadband required.

- Browser: Chrome, Firefox, Edge, or Safari recommended.

- Software: Brightpay (installation guidance included).

- Support: 24/7 technical and course assistance available.

Learning Outcome

- Deep understanding of payroll fundamentals.

- Expertise in Brightpay software operations.

- Mastery of PAYE, taxation, and NI.

- Ability to generate accurate payslips.

- Proficiency in end-of-year payroll reporting.

- Knowledge of compliance with HMRC standards.

- Enhanced skills for managing employee data.

- Competency in real-time information submissions.

- Practical insights into manual and computerised payroll systems.

- Confidence to handle payroll for various business sizes.

Conclusion

Unlock your potential in payroll management with the Payroll Management course at Course Plus. Whether you’re a beginner or a seasoned professional, this course equips you with the skills and knowledge to manage payroll systems confidently and compliantly. Enrol today and take the next step toward a rewarding career in payroll management!

Next Steps:

- Register on Course Plus platform

- Access course materials

- Join community discussions

- Earn certification

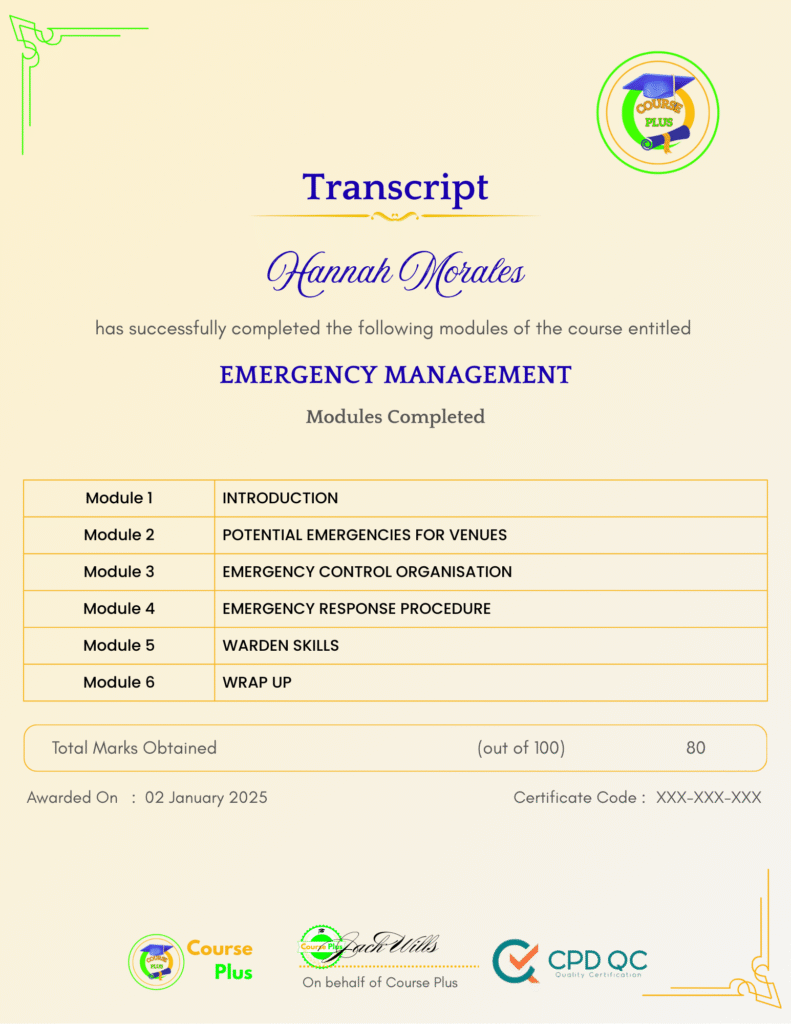

Course Curriculum

INTRODUCTION

-

Introduction

11:00 -

An overview of payroll

18:00

THE UK PAYROLL SYSTEM

-

Running the payroll – PART 1

14:00 -

Running the payroll – PART 2

19:00 -

Manual payroll

14:00 -

Benefits in Kind

10:00 -

Computerised systems

11:00 -

Total Photo scenario explained

02:00

BRIGHTPAY

-

Find Software Per HMRC Brightpay

04:00 -

Installing Brightpay

13:00 -

Add a New Employee

14:00 -

Add 2 More Employees

04:00 -

Settings Bright

04:00 -

Monthly Schedule – 1 Sara Khan

15:00 -

Monthly Schedule – 2 Lana

15:00 -

Monthly Schedule – 3 James

08:00 -

Directors NI

03:00 -

Reports

03:00 -

Paying HMRC

05:00 -

Paying Pensions

04:00 -

RTI Submission

03:00 -

Coding Notices

02:00 -

Journals

07:00 -

Schedule

04:00 -

AEO

07:00 -

Payroll Brightpay Jan and Feb

13:00 -

Payroll Brightpay Leaver

03:00 -

End of Year p60

03:00 -

Brightpay Conclude

04:00

PAYE, TAX, NI

-

Paye Tax

13:00 -

NI

12:00 -

Pensions

06:00 -

Online Calcs

07:00 -

Payslips

04:00 -

BK Entries

06:00

CONCLUSION AND NEXT STEPS

-

Conclusion

08:00

Student Ratings & Reviews

-

LevelIntermediate

-

Duration3 hours

-

Last UpdatedOctober 1, 2025

A course by

Material Includes

- 24/7 Support

- Online e-learning platform

- Interactive modules

- Video-based instruction

- Practical exercises

- Certification (on demand)

- Assessment on demand

Requirements

- Minimum age: 18 years

- Access to a computer with internet

- Willingness to learn and engage

Target Audience

- Payroll professionals seeking to upgrade their skills.

- Small business owners manage payroll operations independently.

- HR and accounting staff in charge of payroll tasks.

- Aspiring payroll specialists looking to kickstart their careers.

- Students and professionals transitioning into payroll management roles.