Capital Budgeting

Course Overview:

Capital Budgeting is a crucial financial process that helps businesses evaluate potential investments and make informed financial decisions. Course Plus presents an in-depth course on Capital Budgeting, covering key aspects such as budgeting environments, cost classifications, forecasting methods, and financial statement analysis. This comprehensive course provides practical insights and real-world examples to ensure learners gain a solid foundation in capital budgeting concepts. Whether you are a professional looking to refine your financial planning skills or a beginner aiming to understand budgeting principles, this course offers a structured learning path to meet your needs.

Why Enroll in this Course?

Enrolling in the Capital Budgeting course on Course Plus will equip you with the essential skills to understand financial planning, cost structures, and investment decision-making processes. This course is designed to help you gain a comprehensive understanding of budgeting environments, cost behavior, and financial forecasting, which are critical for business success. You will learn how to create accurate budgets, allocate indirect costs efficiently, and analyze financial statements effectively. The curriculum is structured to provide a practical approach with real-world examples, enhancing your ability to make informed financial decisions. By completing this course, you will develop the expertise required to manage budgets in a dynamic market and align financial strategies with organizational goals. Take advantage of this opportunity to enhance your financial management skills and advance your career.

Investment Value:

- Gain practical skills to create and manage comprehensive budgets.

- Learn advanced financial forecasting techniques for better decision-making.

- Improve your understanding of cost classification and allocation.

- Enhance your ability to analyze financial statements accurately.

- Increase your career prospects with a valuable financial management skill set.

Technical Specifications:

- Level: Beginner to Advanced

- Mode: Online, self-paced

- Access: Lifetime access with updates

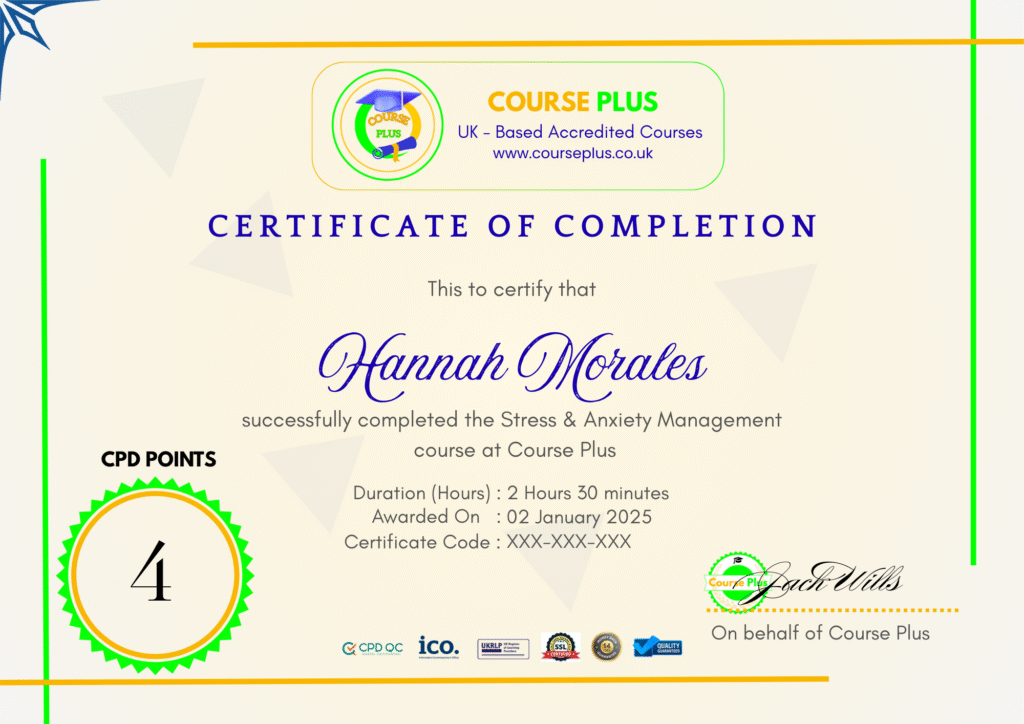

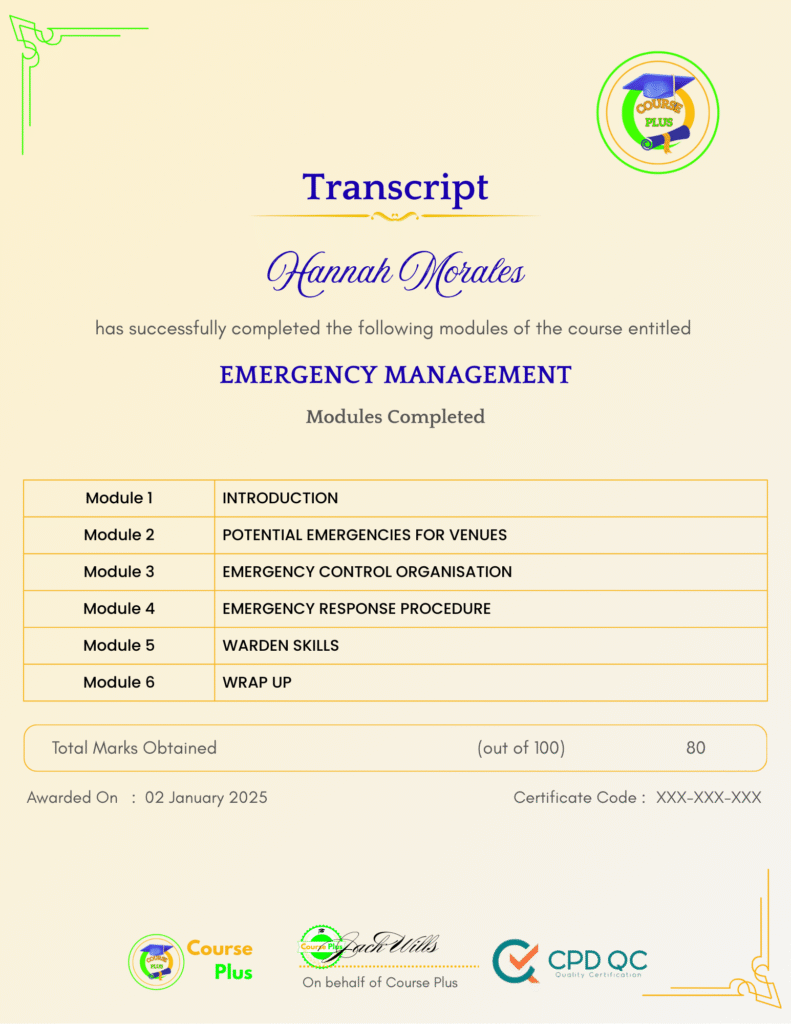

- Certification: Course Plus certificate upon completion(on demand)

Learning Outcome

- Understand the fundamental concepts of capital budgeting.

- Analyze budgeting environments and their impact on financial planning.

- Develop and implement master budgets for businesses.

- Differentiate between direct and indirect costs.

- Allocate indirect costs using various costing techniques.

- Apply cost-volume-profit analysis for strategic decision-making.

- Create financial statements based on budgeting principles.

- Monitor and control budgets effectively.

- Understand the ethical aspects of budgeting.

- Utilize zero-based and project-based budgeting approaches.

Conclusion

The Capital Budgeting course on Course Plus provides an all-encompassing guide to mastering budgeting strategies and financial planning. Whether you’re a business owner, financial professional, or student, this course equips you with the necessary tools to make informed investment decisions and manage budgets effectively. Enroll today to take your financial skills to the next level and achieve your career goals!

Next Steps:

- Register on Course Plus platform

- Access course materials

- Join community discussions

- Earn certification

Course Curriculum

Capital Budgeting

-

Introduction

03:00 -

Budgeting Environment Part 1

03:00 -

Budgeting Environment Part 2

04:00 -

Budgeting Environment Part 3

02:00 -

Master Budget Part 1

06:00 -

Master Budget Part 2

02:00 -

Master Budget Part 3

06:00 -

Principles and Concept of Costing

-

Direct Cost and Indirect Cost

06:00 -

Overhead Allocation

04:00 -

Cost Structure of a Company Part 1

07:00 -

Cost Structure of a Company Part 2

06:00 -

Dividing the Cost

05:00 -

Calculating Indirect Cost

04:00 -

Allocating Indirect Cost

04:00 -

Indirect Cost – Example 1

05:00 -

Indirect Cost – Example 2

04:00 -

Aspects of Costing Behavior

05:00 -

Classification of Cost

06:00 -

Examples of Fixed Cost

05:00 -

Examples of Variable Cost

06:00 -

Fixed Variable Cost

05:00 -

Cost Volume Profit Model – Part 1

05:00 -

Cost Volume Profit Model – Part 2

04:00 -

Case Structure 1

07:00 -

Case Structure 2

06:00 -

Concept of Budgeting and Forecasting

06:00 -

Top Down Approach

06:00 -

Budget and Financial Statements

08:00 -

Budget and Income Statement

08:00 -

Cost of Goods

07:00 -

Budget and Balance Sheet

07:00 -

Inventory

07:00 -

Cash Flow Statement

08:00 -

Cost Structure of Company

06:00 -

Cost Objects

08:00 -

Theory Aspect of Costing

05:00 -

Total Expenses

08:00 -

Projected Expense Growth

04:00 -

Classification of Cost

06:00 -

Balance Sheet Statement

07:00 -

Growth of Liablilites

06:00 -

Direct and Indirect Cost

05:00 -

Budget Monitoring and Control

06:00 -

Mid Year Forecast

06:00 -

Zero Based Budgeting

10:00 -

Project Based Budget

09:00 -

Production Schedule

06:00 -

Costing Schedule

08:00 -

Actual and Estimate Cost

11:00 -

Fixed Variable Cost

05:00 -

Cost – Volume Profit Model

05:00 -

Operating Levearge

04:00 -

Budgeting in Dynamic Market

12:00 -

Behavioral and Ethical Aspects

08:00 -

Organizational Culture

08:00 -

Summary of Case Study

07:00 -

Conclusion

06:00

Student Ratings & Reviews

-

LevelAll Levels

-

Duration5 hours 48 minutes

-

Last UpdatedSeptember 30, 2025

A course by

Material Includes

- 24/7 Support

- Online e-learning platform

- Interactive modules

- Video-based instruction

- Practical exercises

- Certification (on demand)

- Assessment on demand

Requirements

- Minimum age: 18 years

- Access to a computer with internet

- Willingness to learn and engage

Target Audience

- Financial analysts looking to enhance their budgeting skills.

- Business owners aiming to improve financial planning.

- Accounting professionals seeking advanced budgeting knowledge.

- Students pursuing finance and accounting courses.

- Managers responsible for budget monitoring and control.

- Entrepreneurs planning to scale their businesses effectively.