Learn Depreciation Accounting with Advanced Excel Model

Course Overview:

“Learn Depreciation Accounting with Advanced Excel Model” by Course Plus is a comprehensive e-learning course tailored to demystify depreciation accounting while equipping learners with advanced Excel skills. This course offers in-depth knowledge of depreciation and amortization concepts, accounting methods, tax implications, and a hands-on mastery of a robust Excel model designed for depreciation calculations. Whether you’re a professional accountant, a student, or someone managing finances, this course promises to enhance your proficiency in understanding and applying depreciation principles effectively.

Why Enroll in this Course?

Enrolling in the “Learn Depreciation Accounting with Advanced Excel Model” course by Course Plus is your pathway to mastering a crucial aspect of financial management. This course empowers you with a clear understanding of depreciation, amortization, and related financial terms while exploring various methods and their tax implications. Our advanced Excel model simplifies complex calculations, saving you time and effort. By learning how to create, use, and optimize the model, you’ll gain valuable skills applicable in real-world scenarios. Designed with user-friendly guidance and practical examples, this course ensures you stay ahead in your accounting career or financial management tasks. Whether for professional or personal growth, this investment in knowledge pays dividends in your future success.

Investment Value:

- Gain expertise in depreciation accounting and related taxation methods.

- Learn advanced Excel functionalities with practical, real-world applications.

- Master a sophisticated depreciation model to simplify financial calculations.

- Access a course designed for professionals and beginners, ensuring universal relevance.

- Achieve professional credibility and enhance decision-making skills in finance.

Technical Specifications:

- Desktop, Laptop, or Tablet with MS Excel 2016 or later.

- Stable internet for video lessons and resource downloads.

- Lifetime access to course materials.

Learning Outcome

- Define and differentiate depreciation and amortization.

- Identify the most common depreciation methods and their applications.

- Account for depreciation with precision and accuracy.

- Understand depreciation tax shields under various methods.

- Utilize an advanced Excel depreciation model effectively.

- Analyze depreciation methods for tax optimization.

- Perform in-depth financial analysis using Excel functions.

- Simplify complex calculations with Excel automation.

- Apply knowledge to real-world business scenarios.

- Enhance professional accounting and financial management skills.

Conclusion

Open the secrets of depreciation accounting with Course Plus! Our “Learn Depreciation Accounting with Advanced Excel Model” course combines theory and practice, ensuring you develop professional skills for immediate application. Whether for career growth or personal finance, this course is your gateway to mastering financial strategies effortlessly.

Next Steps:

- Register on Course Plus platform

- Access course materials

- Join community discussions

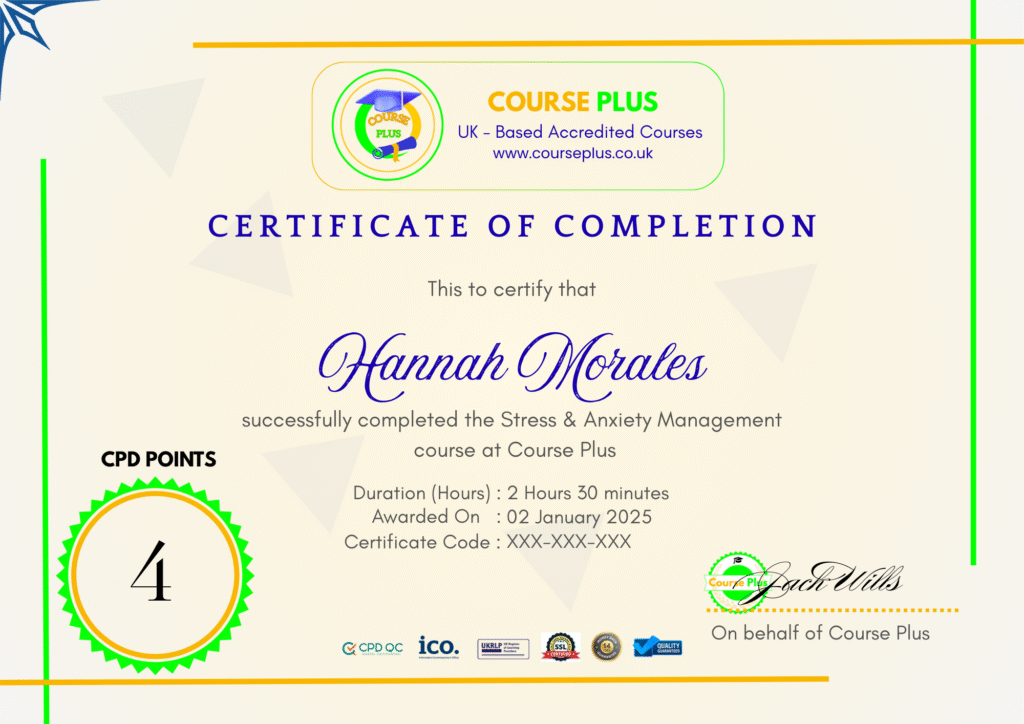

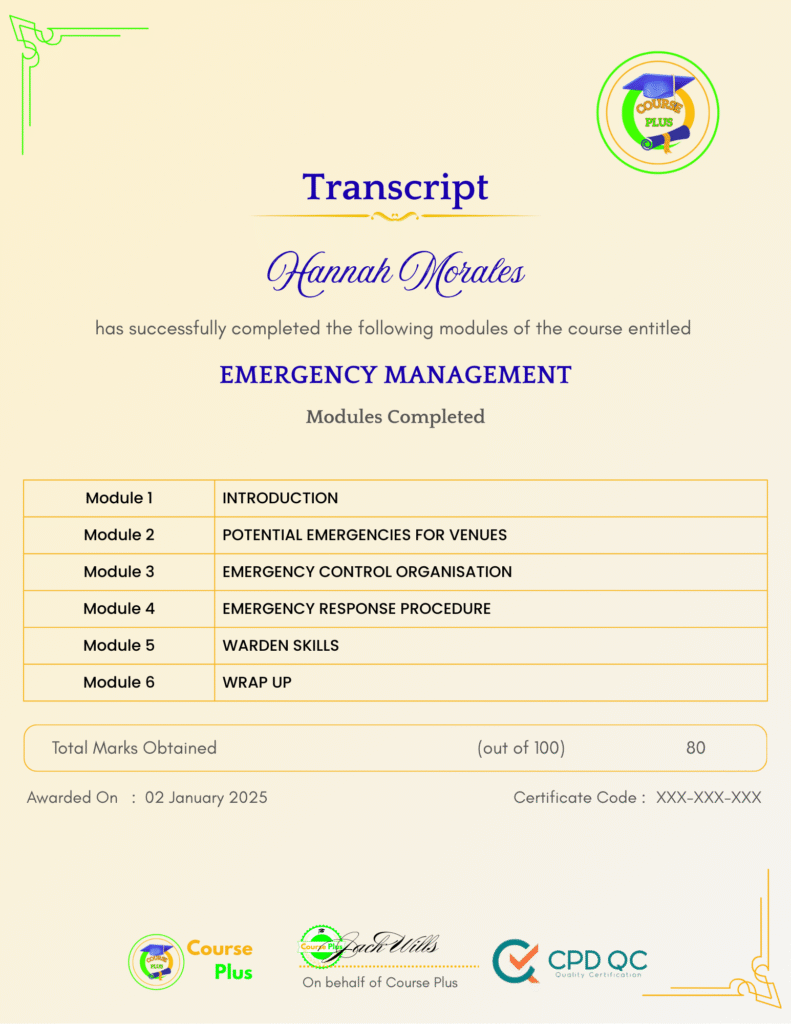

- Earn certification

Course Curriculum

INTRODUCTION

-

Introduction

04:00 -

Minimum requirements before taking the course

02:00

WHAT IS DEPRECIATION? WHAT IS AMORTIZATION? AND RELATED TERMS

-

Definition of Depreciation

02:00 -

What is amortization? (Depreciation vs Amortization)

03:00 -

What are the related terms (other terms) to Depreciation?

02:00

VARIOUS METHODS OF DEPRECIATION AND DEPRECIATION ACCOUNTING

-

Most common methods of Depreciation

09:00 -

Accounting for Depreciation

05:00

DEPRECIATION AND TAXATION

-

Depreciation Tax Shield

05:00 -

Depreciation Tax Shield Under Various Depreciation Methods

04:00

MASTER DEPRECIATION MODEL (HOW TO USE)

-

Introduction and basics of Depreciation Model in Excel

02:00 -

Deep Dive into Depreciation Model

08:00 -

How to use the model with Example

11:00 -

Advanced functionalities of the Model

11:00

CONCLUSION (THANK YOU)

-

Conclusion

01:00

Student Ratings & Reviews

-

LevelAll Levels

-

Duration1 hour 9 minutes

-

Last UpdatedSeptember 30, 2025

A course by

Material Includes

- 24/7 Support

- Online e-learning platform

- Interactive modules

- Video-based instruction

- Practical exercises

- Certification (on demand)

- Assessment on demand

Requirements

- Minimum age: 18 years

- Access to a computer with internet

- Willingness to learn and engage

Target Audience

- Accounting professionals seeking advanced skills in Excel and depreciation.

- Business owners managing asset depreciation and taxation.

- Students studying accounting or finance.

- Financial analysts looking to deepen their expertise.

- Non-professionals aiming to understand personal finance depreciation.

- Anyone with an interest in enhancing their Excel modeling capabilities