Creating a Robust Financial Plan – Financial Statements

Course Overview:

Master the fundamentals of financial planning with Course Plus’s “Creating a Robust Financial Plan – Financial Statements.” This comprehensive course is designed to help learners build a solid foundation in interpreting, analyzing, and leveraging financial statements. From understanding the income statement and cash flow considerations to modeling different financial scenarios, you will acquire essential skills to optimize financial performance for any business. Whether you’re a budding entrepreneur or an established professional, this course equips you to make informed financial decisions confidently.

Why Enroll in this Course?

Understanding financial statements is a vital skill for anyone managing or planning a business. This course on Creating a Robust Financial Plan – Financial Statements by Course Plus provides in-depth insights into income and cash flow statements, key financial metrics, and practical modeling techniques. You’ll learn how to interpret financial statements to identify business trends, make data-driven decisions, and communicate financial strategies effectively. Tailored for professionals and beginners alike, this course ensures you grasp complex concepts easily through clear and structured lessons. With industry-relevant case studies and hands-on worksheets, you’ll develop a skill set that enhances business success. Enrol now to transform your financial literacy into actionable expertise.

Investment Value:

- Affordable, in-depth financial education with lifetime access to course materials.

- Learn essential financial planning skills that can directly impact your business’s success.

- Gain access to practical worksheets and tools to apply your learning.

- Increase your earning potential by mastering financial analysis and decision-making.

- Be certified by Course Plus, a trusted name in online education.

Technical Specifications:

- Online, self-paced video lectures.

- No prior financial knowledge required.

- Certificate of completion provided by Course Plus.(on demand)

- Mobile-friendly platform with subtitles and transcripts.

Learning Outcome

- Understand the structure and purpose of income statements.

- Learn the five key areas of an income statement.

- Grasp the inputs and outputs of income statements and cash flow statements.

- Analyze business trends through profit and loss (P&L) narratives.

- Create and interpret cash flow statement worksheets.

- Differentiate between aggressive, conservative, and most likely modeling styles.

- Use financial statements to support strategic decision-making.

- Identify cash flow considerations to manage liquidity effectively.

- Develop financial modeling skills for real-world business scenarios.

- Enhance your ability to communicate financial performance to stakeholders.

Conclusion

Transform your financial planning skills with Course Plus’s Creating a Robust Financial Plan – Financial Statements. By mastering income and cash flow statements, you’ll gain the confidence to make smarter business decisions and achieve long-term success. Enroll today and take the first step toward financial literacy and strategic expertise!

Next Steps:

- Register on Course Plus platform

- Access course materials

- Join community discussions

- Earn certification

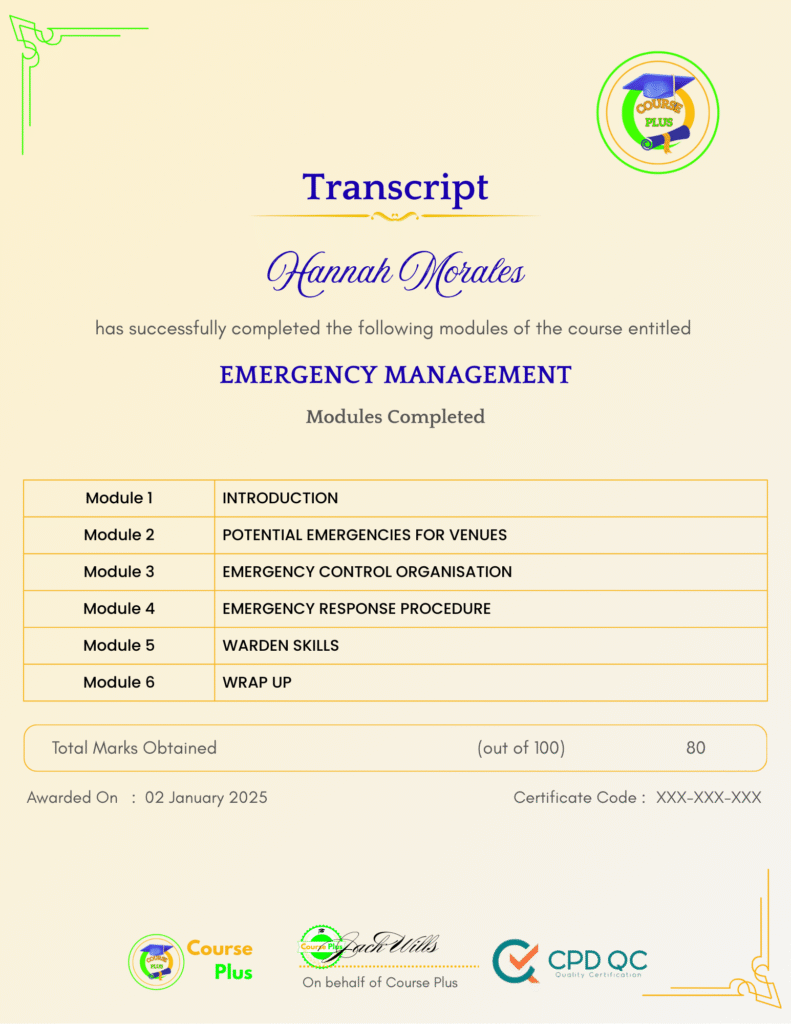

Course Curriculum

INCOME STATEMENT EXPLAINED

-

Income Statement and Cash Flow Considerations

05:00 -

Income Statement (P&L) Basics

01:00 -

Income Statement (P&L) Tells a Story about Your Business

02:00

INCOME STATEMENT WALK-THROUGH EXPLAINED

-

5 Key Areas of an Income Statement (P&L)

06:00 -

Income Statement (P&L) Inputs

07:00

CASH FLOW STATEMENT

-

The Cash Flow Statement Worksheet

08:00 -

Modeling Styles: Aggressive, Conservative, and Most Likely

03:00

Student Ratings & Reviews

-

LevelAll Levels

-

Duration32 minutes

-

Last UpdatedSeptember 30, 2025

A course by

Material Includes

- 24/7 Support

- Online e-learning platform

- Interactive modules

- Video-based instruction

- Practical exercises

- Certification (on demand)

- Assessment on demand

Requirements

- Minimum age: 18 years

- Access to a computer with internet

- Willingness to learn and engage

Target Audience

- Entrepreneurs and business owners aim to understand their finances better.

- Financial professionals seeking to refresh or deepen their knowledge of financial statements.

- Students and career changers pursuing finance or accounting roles.

- Managers responsible for financial performance in their departments.

- Non-financial professionals wanting to enhance their business acumen.

- Aspiring investors analyzing financial performance of companies.