Creating a Robust Financial Plan-The Fundamentals

Course Overview:

Welcome to “Creating a Robust Financial Plan—The Fundamentals“, an expertly designed course on Course Plus. This course empowers entrepreneurs and professionals to master financial planning, covering critical topics like financial projections, revenue models, and financial statements. With practical insights into overcoming roadblocks and understanding why financials matter to investors, you will gain actionable skills to create believable and compelling financial plans. Whether you’re a small business owner, startup founder, or finance enthusiast, this course equips you with the knowledge to secure your financial future and drive business success.

Why Enroll in this Course?

If you’re striving for financial clarity and business success, “Creating a Robust Financial Plan—The Fundamentals“ on Course Plus is your key to achieving it. Learn the critical importance of financial planning to attract investors, avoid common financial pitfalls, and secure business sustainability. This course provides practical tools to tackle financial challenges, create top-down and bottom-up projections, and craft believable financial statements. With a focus on actionable insights and real-world scenarios, you’ll develop the confidence to justify your financials effectively. Our step-by-step modules ensure you stay informed and ahead of the competition. Enroll today to build a solid foundation for financial planning and unlock opportunities for your business growth.

Investment Value:

- Affordable learning for both entrepreneurs and professionals.

- Gain expertise in financial planning to improve business operations.

- Access to tools for developing accurate financial projections.

- Learn strategies to overcome common roadblocks in financial planning.

- Lifetime access to course materials for ongoing reference.

Technical Specifications:

- Format: Online, self-paced learning on Course Plus.

- Devices: Accessible on desktop, tablet, and mobile.

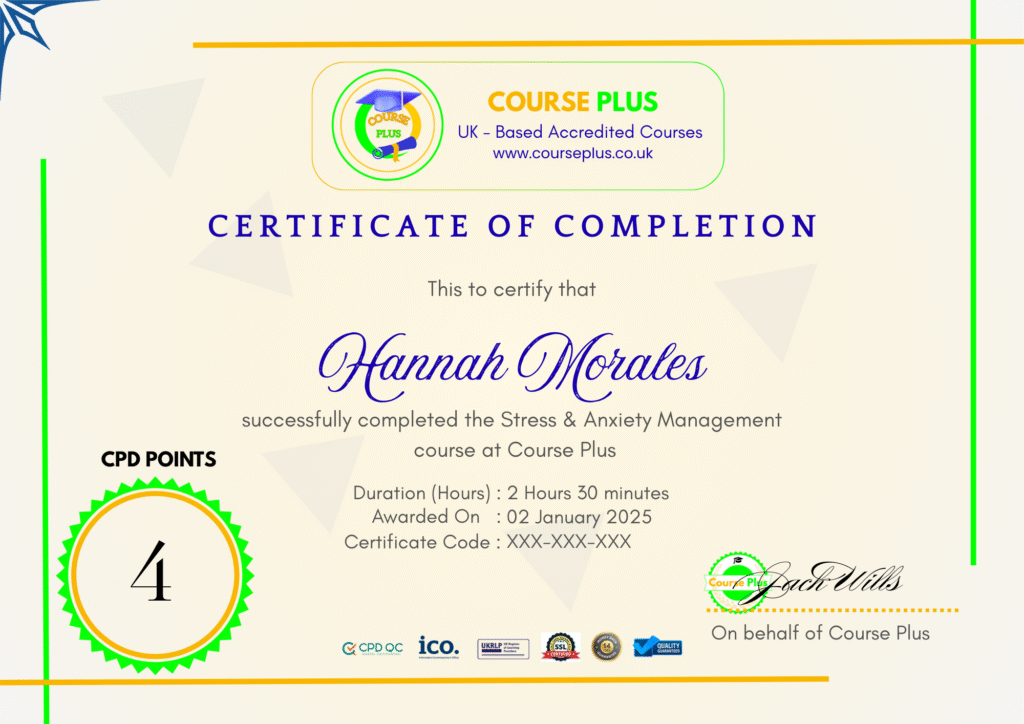

- Certification: Downloadable certificate upon completion. (on demand)

- Requirements: Internet access and basic financial knowledge.

Learning Outcome

- Understand the fundamentals of financial planning.

- Create realistic top-down and bottom-up financial projections.

- Differentiate between revenue models for various industries.

- Develop financial statements that are investor-ready.

- Identify and overcome common financial planning challenges.

- Learn why financials are critical to business success.

- Avoid pitfalls that cause businesses to fail.

- Justify financials effectively to stakeholders.

- Build a believable financial plan for business growth.

- Gain the confidence to make sound financial decisions.

Conclusion

Master the fundamentals of financial planning with Course Plus and take control of your financial future. From creating believable financials to understanding revenue models, this course equips you with the tools to succeed. Enroll today and gain the confidence to make informed financial decisions that attract investors and drive business growth.

Next Steps:

- Register on Course Plus platform

- Access course materials

- Join community discussions

- Earn certification

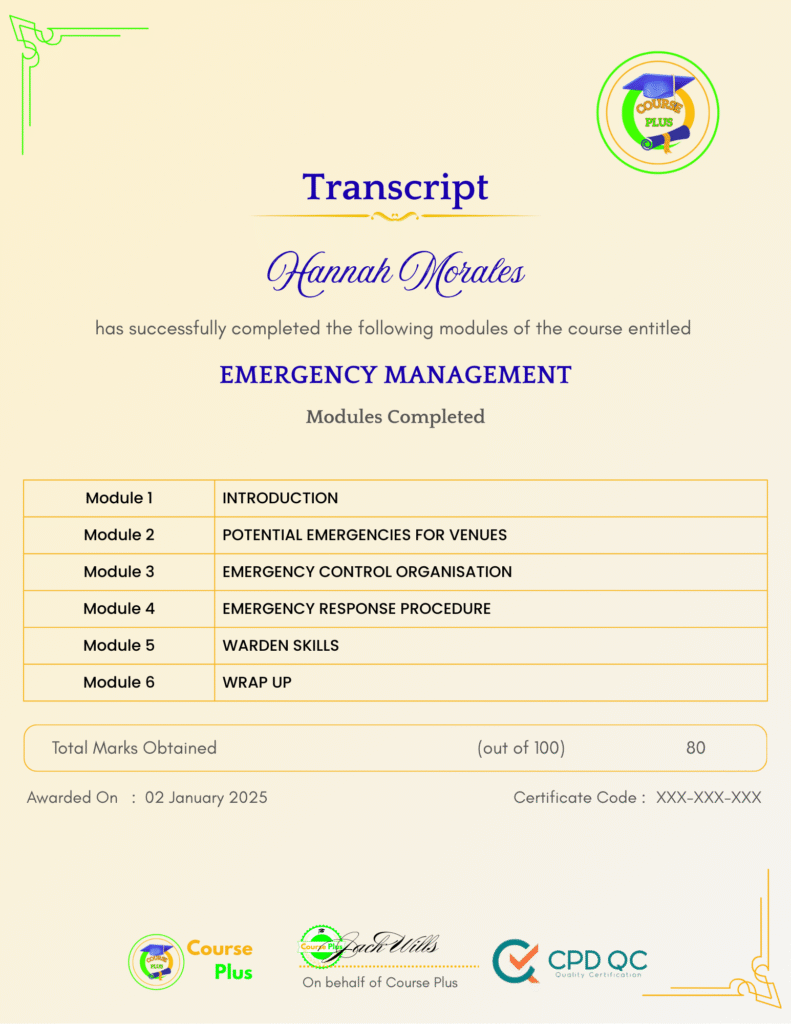

Course Curriculum

INTRODUCTION

-

Financial Concepts Covered

06:00

JUSTIFYING YOUR FINANCIALS FOR BEST RESULTS

-

Justifying Your Financials

03:00 -

Why Financials Matter

03:00 -

Keys to Success

05:00 -

Why Are Financials Important to Investors?

02:00 -

Why Businesses Fail

03:00

OVERCOME ROADBLOCKS TO FINANCIAL PLANNING

-

Financial Challenges of Entrepreneurs

07:00 -

Financial Resolve

02:00

CREATE YOUR FINANCIAL PLAN

-

Financial Projections: Top-Down

04:00 -

Financial Projections: Bottom-Up

05:00 -

Advantages and Disadvantages of Top-Down vs. Bottom-Up

03:00 -

Revenue Models

09:00 -

Financial Statements

07:00 -

Make Your Financials Believable

07:00

Student Ratings & Reviews

-

LevelIntermediate

-

Duration1 hour 6 minutes

-

Last UpdatedSeptember 30, 2025

A course by

Material Includes

- 24/7 Support

- Online e-learning platform

- Interactive modules

- Video-based instruction

- Practical exercises

- Certification (on demand)

- Assessment on demand

Requirements

- Minimum age: 18 years

- Access to a computer with internet

- Willingness to learn and engage

Target Audience

- Entrepreneurs aiming to secure investments.

- Small business owners seeking financial sustainability.

- Startups needing to present compelling financial plans.

- Finance students looking to enhance practical skills.

- Professionals involved in business planning.

- Non-professionals interested in financial literacy.